Form 2290 Heavy Highway Vehicle Use Tax Claiming Credit

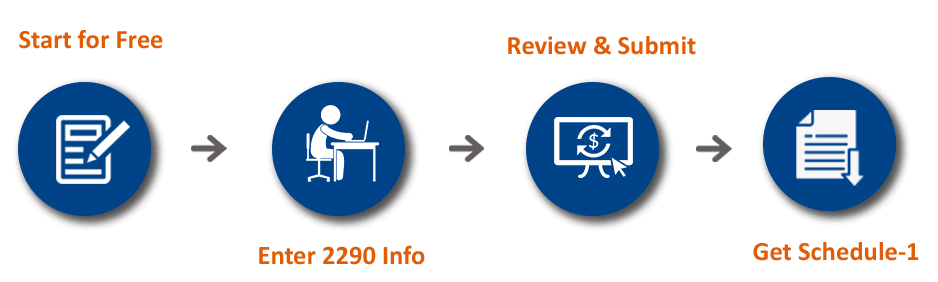

You can claim a credit for the heavy vehicles which are overpaid during the tax period. Truck holders can easily get a credit from the IRS which are reported by Filing IRS Form 2290 Online.

1. Claim a credit for the heavy vehicles which are stolen, sold, or destroyed before the June 1st.

2. Also, you can receive the credit of the vehicles when their mileage limit is 5,000 miles or less (7,500 miles or less for the agricultural vehicles).

Claiming a credit or refund is not possible for the lower weight class vehicles. For example, you registered your vehicle with the 80,000 lbs or more. Perhaps, you only used your vehicle at the low weight. In this case, you cannot claim a refund from the IRS. You can claim a credit when you run your vehicle with the low mileage limit of 5,000 miles or low (7,500 miles or low for agricultural vehicles). If you run your vehicle with the high mileage limit for a portion of tax period then you are not able to claim a credit from the IRS.

Credit, Stolen or Sold Vehicles

There is a possibility to claim a credit for the Credit, Stolen, or Sold Vehicles from the Internal Revenue Service. Truck holders can claim a credit easily by providing their Vehicle Identification Number (VIN), Gross weight of the Vehicle, also you need to enter the date of your vehicle destroyed, stolen, or sold out. By mentioning the above details in the IRS Form 2290 Online in the next tax period. Also, you can use Form 8849 to claim a credit.

Credit for the Low Mileage Vehicles

The vehicles which used with the low mileage limit of 5,000 miles or less (7,5000 miles or less for agricultural vehicles) then you can get a credit from the IRS. If your vehicle exceeded then the given mileage limit then you are not liable to claim a credit from the IRS. You cannot claim a credit of low mileage limit used vehicles until you reached the end of the tax period.

When the Tax Amount is Overpaid?

If taxpayers paid the tax amount twice then they can have the chance to claim a credit from the IRS. Truck holders can claim a credit when then filed IRS Form 2290 Online with the same Vehicle Identification Number (VIN). Therefore, in the case of Filing 2290 Online for same VINs then you can claim a credit from the IRS.

Truck holders must File Form 8849 Online to claim a credit. You can easily claim a credit from the IRS by logging into Form2290Filing.com account. Use Form 8849 on our database and File it to get a credit on your suspended vehicles. You can directly call to our customer support team to know about the Form 2290 IRS Online Filing and also about the Claiming of a credit.

File Form 2290 For 2025 – 26 Now!

File Form 2290 For 2025 – 26 Now!